Bitcoin price in April entered about 83.2 thousand dollars after dipping it about 4 % a month. However, what causes anxiety is that feelings in the market are not good, at the very least. However, let’s see if April and Q2 are likely to be better for BTC and the wider encryption market.

Meanwhile, the veteran encrypted “Ali Martinez” referred to the Bitcoin Index.

Regarding the “Weather” in the structure

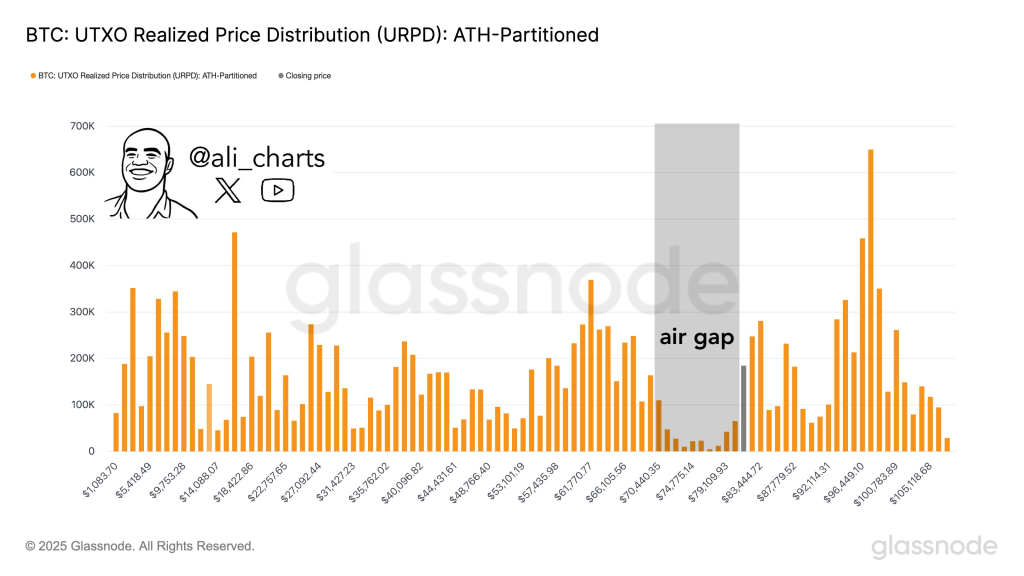

Martinez shared a critical plan in Glassnode showing the distribution of the achieved price for Bitcoin (URPD). This main scale reveals the place where the current Bitcoin holders have their coins. It provides an insight into actual support areas. It depends on the history of transactions instead of analyzing speculation.

The most disturbing advantage in the chart is what Martinez calls a “air gap” between $ 70,000 and $ 80,000. This gray area shows a significantly low UTXO activity. Very few holders of bitcoin in this price range. Without large historical transactions in this region, there is a minimum support on the chain to prevent rapid price movement.

This raises anxiety for current holders. If Bitcoin decreases to less than 80,000 dollars, there is little to prevent him from slipping quickly to $ 70,000. There will be no significant purchase pressure to slow down the landing.

Bitcoin powerful support levels

Dide activity groups appear less than 70 thousand dollars, especially about 60 thousand dollars, 50 thousand dollars and 40 thousand dollars. These areas represent stronger areas of historical accumulation. Several UTXOS were created at these levels. It is possible that you will be strong support for the series as previous buyers may intervene again.

The BTC also shows a huge Bitcoin size in the range of $ 100,000-105 thousand dollars. This indicates that the participants in the new market enter the current highlands. This area can serve as a resistance area if prices decrease and re -test from below.

Martinez tweet the essence of the graph: “Less than 80,000 dollars, BTC faces $ air gap! There is no support to $ 70,000.” This is a warning signal for the short -term BTC price. The current price structure lacks historical support in a range between 70 thousand dollars and 80 thousand dollars.

Also read: Bitcoin prediction: The analyst set 3 price goals for BTC in 2025

The effects of traders and investors

Traders should be aware of several major points:

- Risk management is crucial. Anyone who trades in the range of $ 80,000 to $ 100,000 must know that there is a minimum support on the chain up to $ 70,000. If the correction begins, it may be fast and sharp.

- In the long term investors may consider a range of $ 60,000 to $ 70,000 as an entry or more solid entry area. This depends on the high Utxo density in those areas.

- If BTC is more than $ 80,000 despite the air gap, then it shows the upholstery. Low support lands will be traded without falling.

UTXO achieved price distribution It is a strong measure of bitcoin analysis. It helps in identifying support and resistance areas on the basis of the actual treatment date. When Bitcoin enters a price range with a little historical activity, there is a lower incentive for holders to buy or defend this price. This makes the price more volatile within this range.

Follow us X (twitter)and Coinmarketcap and Binance Square For more daily encryption updates.

Get all our future calls by joining A free telegram group.

We recommend etoro

The community of active users and social features such as news extracts, and chats to obtain specific metal coins available for trading.

A wide range of assets: cryptocurrencies along with other investment products such as stocks and traded investment funds.

Trading copies: It allows users to copy prominent traders trading, for free.

Easy to use: ETORO web platform on the web -based etoro and the mobile application is easy to use and easy to move.

adxpro.online