Bitcoin price was stuck within the scope of uniformity of $ 81,000 to 86,000 dollars during the past week, indicating a high level of lack of caution between bulls and bears. Although most of the chain indicators paint a declining image of the first cryptocurrency, the latest data indicates that Rull Run may not have ended yet.

BTC investors are not yet in full panic: Blockchain

In a new post on the X platform, Glassnode Blockchain Analytics open A specific category of bitcoin holders known as “short -term holders” (STH) face increased market pressure. This observation depends on the series on the value of the unrealized losses of this invested regiment.

For clarity, the unrealized loss indicates a loss that is still on paper, as the investor still adheres to the sale of the original (with a value of decline). The loss only becomes “real” or “achieved” when the original holder sells a value of less than the purchase price.

According to Glassnode, the unreasonable losses of bitcoin investors climbed in recent weeks, and pushed short -term holders specifically towards a large threshold +2σ. The STH is associated with the Extreme +2σ Speaker, to increase the sale pressure in the past.

However, Glassnode indicated that the size of Sth’s losses is still decreased within the range that was usually observed on the upward market. Specifically, the size of these losses is diminished compared to the sale at the market level in 2021, indicating that the bull cycle may not be done yet.

Source: @glassnode on X

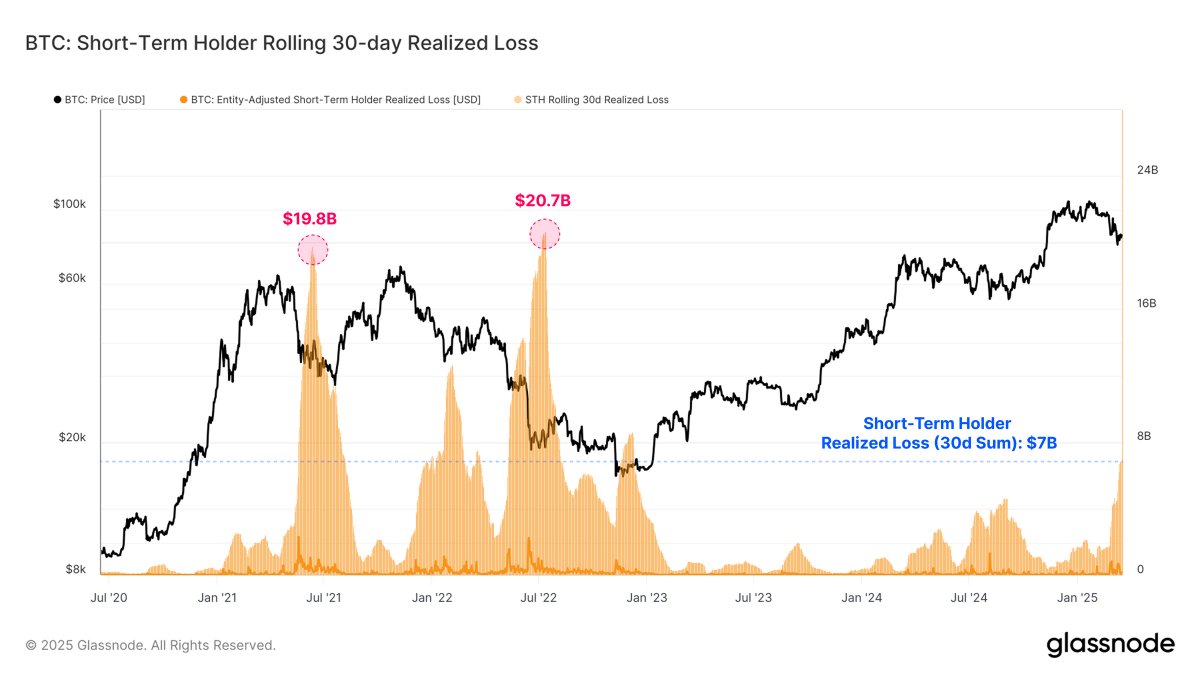

To clarify this, Glassnode revealed that the 30 -day achieved loss for Bitcoin holders has now exceeded $ 7 billion, which represents the largest sustainable loss event in the current session. Despite the importance of this number, it is still much less severe than the surrender events that were seen at the beginning of the previous bear markets.

For example, Bitcoin’s achieved losses increased to $ 19.8 billion and $ 20.7 billion during major price corrections in May 2021 and 2022, respectively. Given that the losses achieved are still much lower than previous surrender events, there is an opportunity to not reach the market on a large scale.

Bitcoin price at a glance

As of the writing of these lines, the bitcoin price is about 84,300 dollars, which reflects an increase of 0.3 % over the past 24 hours. According to data from Coingecko, the main cryptocurrency has decreased by only 0.6 % in the past seven days, focusing on the volatile state of the market.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Distinctive image from Istock, tradingvief chart

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.

adxpro.online